Digital Account Open

Overview

Led a team of 6 designers to revolutionize how Financial Advisors opened accounts for their clients at Charles Schwab by retiring a cumbersome paper process and replacing it with a digital experience. By designing and launching a seamless, more accurate, more secure, and more robust process for both Advisors and their clients we were able to drive resoundingly positive outcomes:

$250 Million in revenue in the first year

33% Reduction in Advisor operational toil

50% Reduction in client time to complete the account opening process

60% reduction in processing times driving $8 Million in annual cost savings

The Problem

Advisors and their Clients largely use a slow, costly, and insecure paper process. How can we provide end clients with a modernized account opening experience that feels more secure and streamlined while reducing Advisor processing time so they can spend more time managing their client's portfolios

We also used this as an opportunity to retire antiquated technologies and processes that caused user pain and extra toil. The paper process was highly error prone and we took care to create an experience that ensured data accuracy to expedite account opening.

The Goals

We partned with business, engineering, and research partners to define our key objective and how we would measure our success via measurable goals.

Objective:

We want to make it easier for end clients to comprehend and complete the account opening journey. We want to make the whole process faster and more efficient. And we want Advisors and their clients to be able to do more activities at one time.

Success Measures

Grow Assets Under Manamagment, Reduce Account Processing time, Reduce Advisor operation task time, Achieve System Usability Score of 80

The Approach

In order to meet our success measures and begin with an informed foundation we conducted extensive research to understand the current process and evaluate the currently floundering product in market to uncover opportunites and pain points as well as conducting internal heuristic evaluations to raise the bar of the experience.

Our critical insights from this reasearch were:

Unclear data sources and confusing language

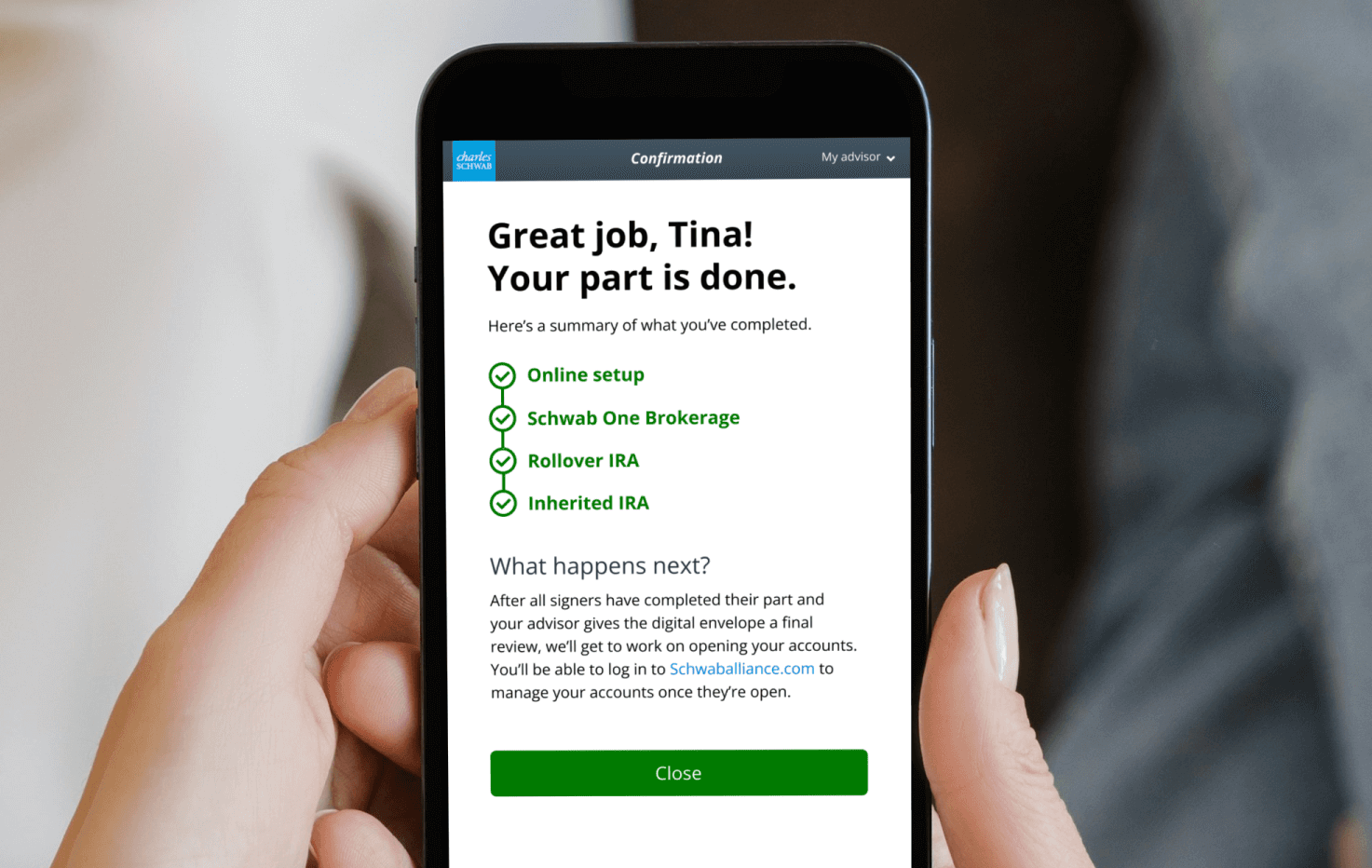

Clients are unlikely to read legal language and the journey’s conclusion lacked significance

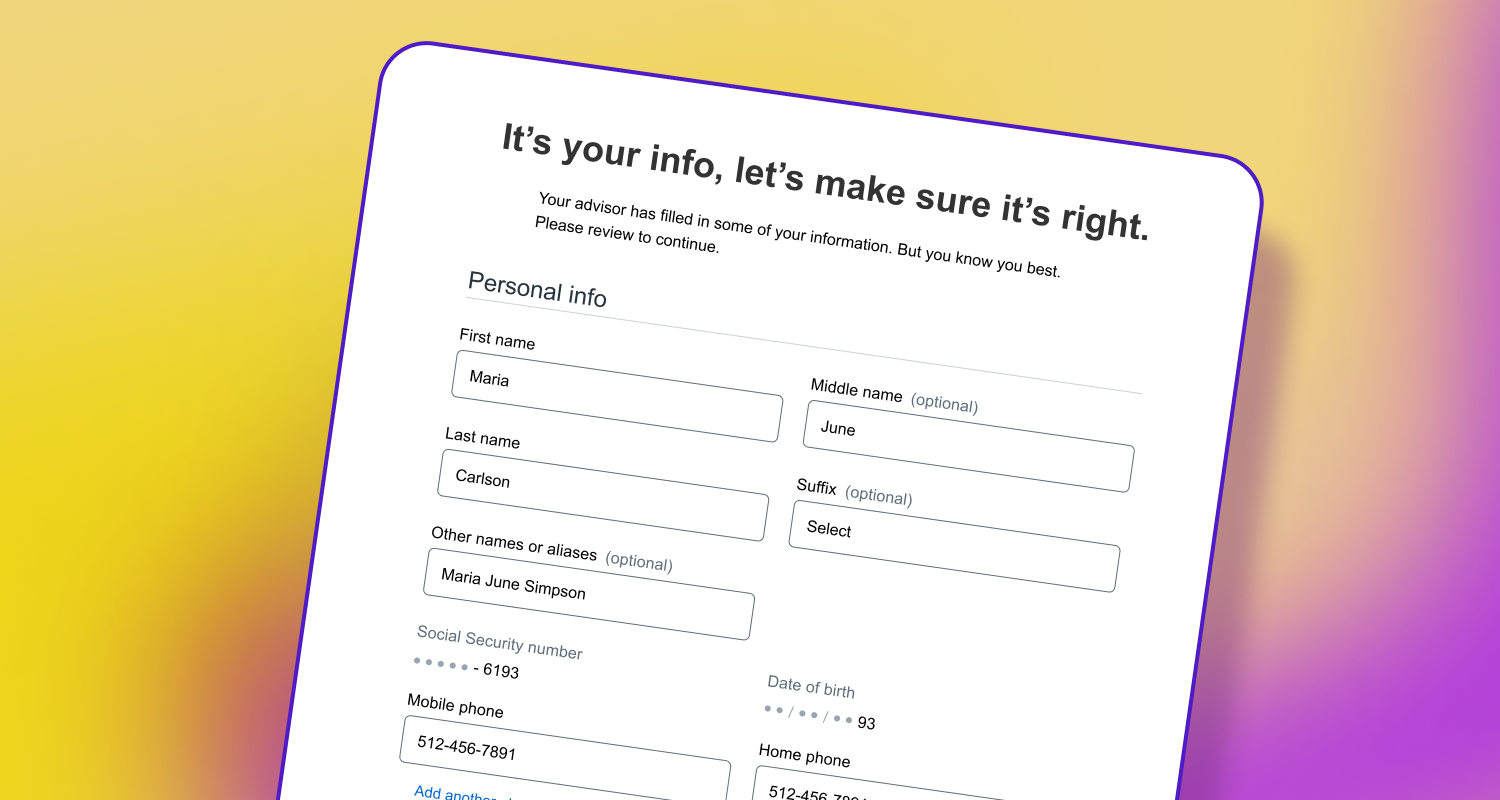

Lack of Client agency and ability to redtify incorrect data

Users and Advisors alike found the workflow confusing and mismatched to their mental models

Structure and Value

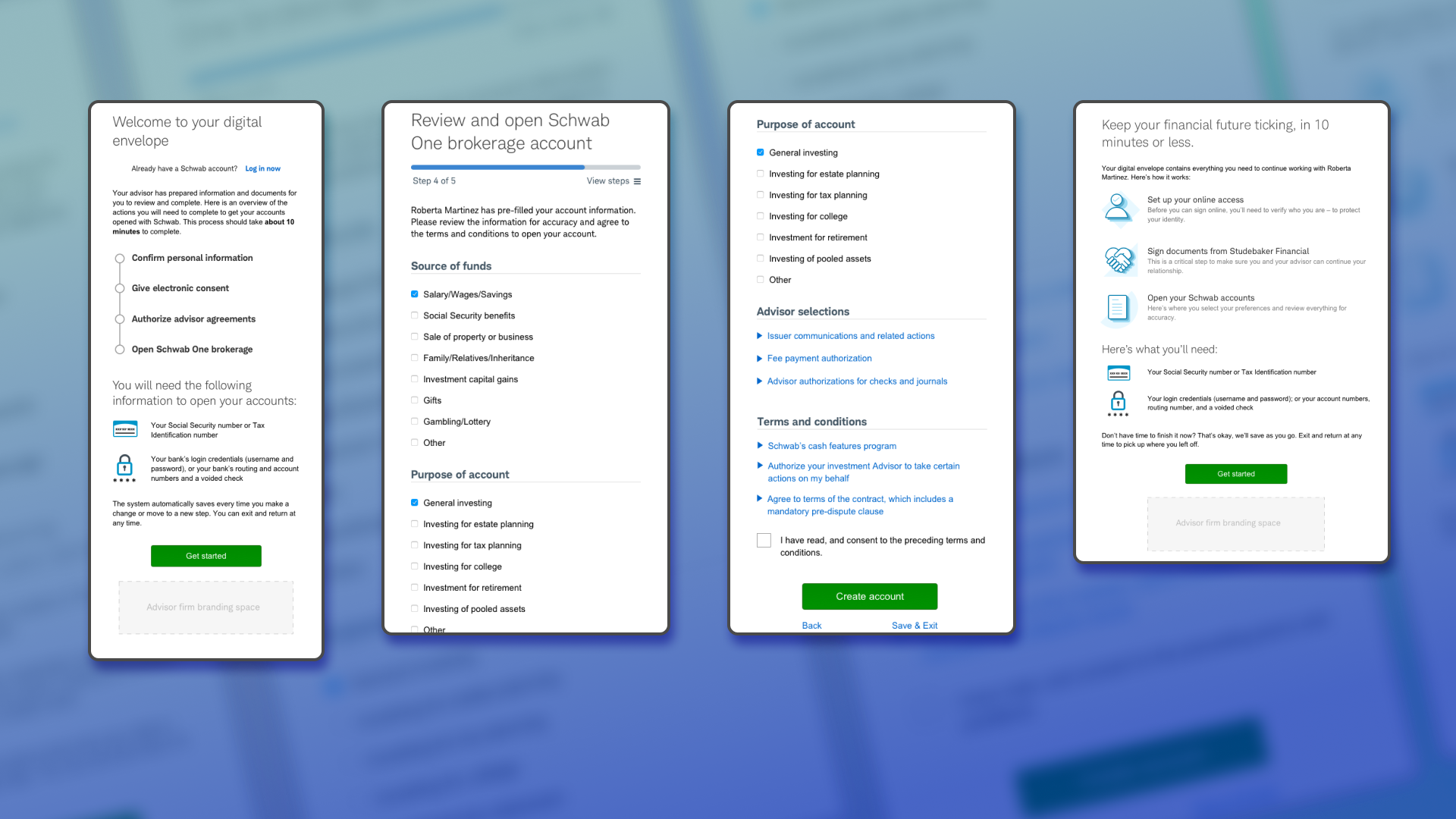

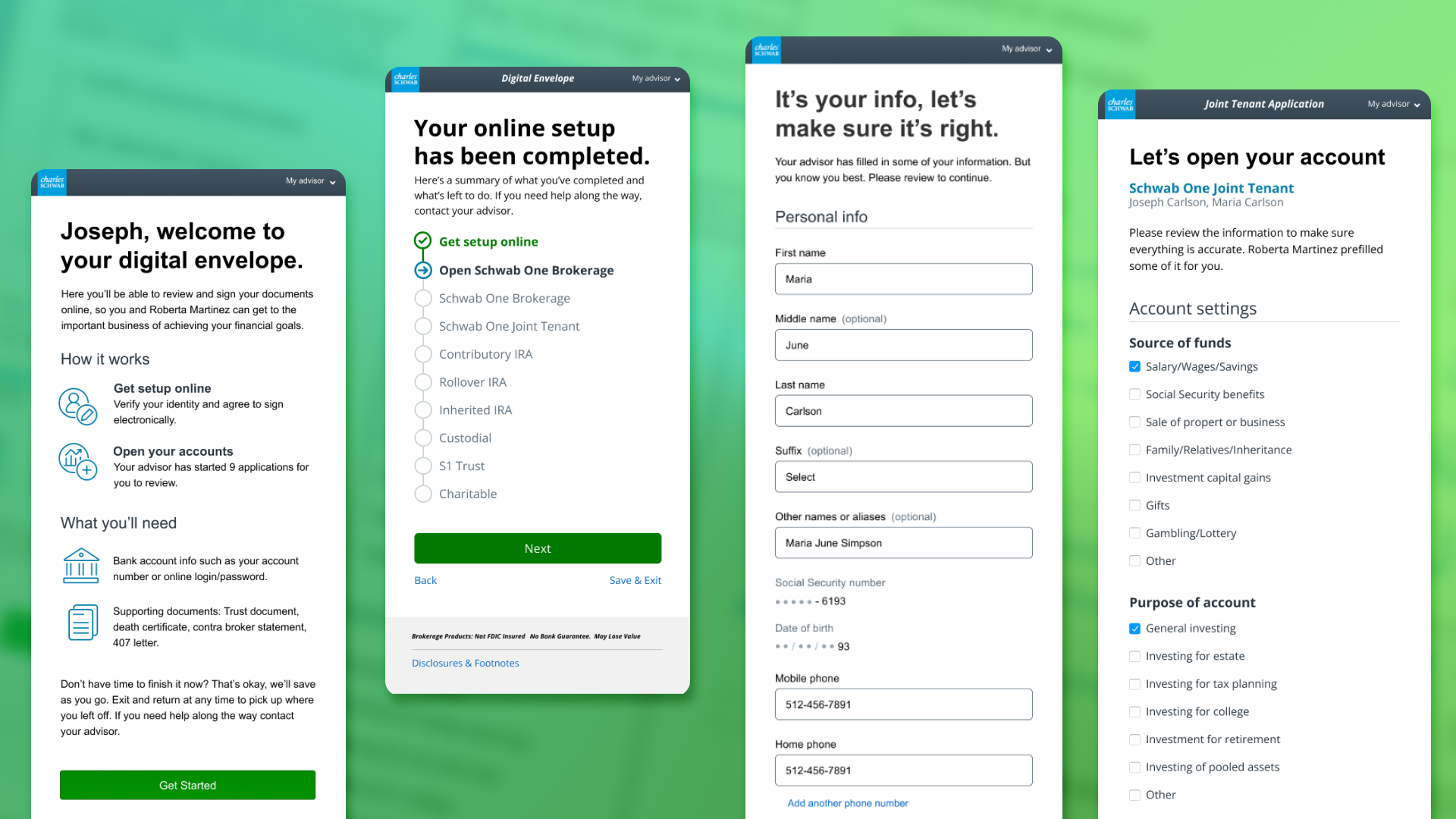

With this data in hand we gathered the core team to conduct a Design Sprint to prioritize use cases, deliver the maximum value for the users. We set the overall foundation for the new experience including aligning on the core user journey, a modular appraoch for the account opening process, and core feature enhancements and design patterns to leverage to achieve a truly modern experience that would drive adoption.

Setting the Direction

I developed the high level, mid-fidelity mockups and strategy for the team to set the design direction and leverage a newly developed design language. As we worked through the initial sets of designs, with each aspect of the process needing it's own nuanced approach and unique tasks our scope expanded to include the Advisor side of the Account opening process and I expanded the design team to account for the additional work

Learning & Pivoting

It was part of our approach to constantly be testing with end users, and our mid-stream user testing indicated that we were hitting our usability score goals but we were still missing the mark on users understanding their progress through the experience, how to pick up where they left off, and coudn't differentiate between activites in the process leading to task blindness and not being able to adequetely feel comfortable and secure with their data at the end of the process. We also learned there was not adequete friction for users, the process was too seamless and it made them suspect the reputable nature of the application

We rapidly worked to address these insights and largely improved the experience so that when we launched we had high confidence in our ability to meet our success metrics and deliver a great experience for our users.

The Results

Our massive effort launched to overwhelming success. Users praised the new tools and easy to use process which simplified complex information and amde them feel more secure with their information. Advisors rapidly began adopting the tool to dramatically expedite their onboarding process and spend more time focusing on their custoemrs.

Revenue Generation

In the first year of launch we drove $250 Million in revenue and an increase in 37 Billion Assets Under Management

Easier for Everyone

The digitally streamlined experience saw an overall 33% Reduction in Advisor operational toil and 50% Reduction in client time to complete the account opening process

Time Savings = Dollar Savings

With this highly secure transimission of data validated by both Advisors and End Users we were able to see a 60% reduction in processing times driving $8 Million in annual cost savings