Credit Card Modernization

Overview

Kohls wanted to provide customers with a more appealing and valuable credit card that encouraged additional purchases, increased the number of cards opened and owned by customers, and deepened customer loyalty & retention. We completely revamped our internal systems and Service Design, enhancing numerous facets of the customer experience, online and in stores, to updgrade almost 1 million customers to the new cobranded card.

The card launch and Service Design has been a huge success story driving:

$410 Million in revenue in the first year

$850 Million in combined internal and external sales in the first year

77% activation rate among converted customers

Nearly 1 million customers converted

The Problem

Kohls wanted to find a new backer for their credit lines to both exit an unfavorable relationship with their current partner while also finding a new one that could help them expand on their already well liked credit card terms for customers. Kohls partnered with Capitol One to release a new cobranded card that allowed customers to earn rewards on purchases outside of Kohls. Just under 1 million customers were selected to be converted from an existing credit line and upgraded to the new cobranded card.

The initiative was split into a handful of tracks that were responsible for specific aspects of the project. I had a dual role where I was directly responsible for driving all the cross functional work on the "Use My Card" track where we needed to ensure the card worked for all transactions in all scenarios on day 1. I also served as the Design Lead for the initiative guiding many designs across both organizations ensuring we enhanced and drove consistency the experience across our web, in-store, and customer service experiences for transacations, rewards, returns, account look up and more.

The Work

Working across multiple teams with Engineering, Product, and Business Partners we defined the core set of use cases that needed to be accommodated for users in order to make using the new credit card seamless. These use cases ran across over 8 different products at Kohl's and Capitol One.

At the same time I worked with the designers on the project to outline all the critical user touchpoints that needed to be updated and enhanced for rollout. This included everything from Self-Check-Out, to Rewards Management Online and in our Mobile App, to Returns and Customer Service Call Centers.

We conducted initial user testing on all of these critical user experiences to identify existing customer pain points and cross prioritized those needs with the enhancements that needed to be driven by the new card. We took these opportunities to upgrade and streamline processes that were painful for our existing Credit Customers, benefits that cascaded out to improve the experience for all customers.

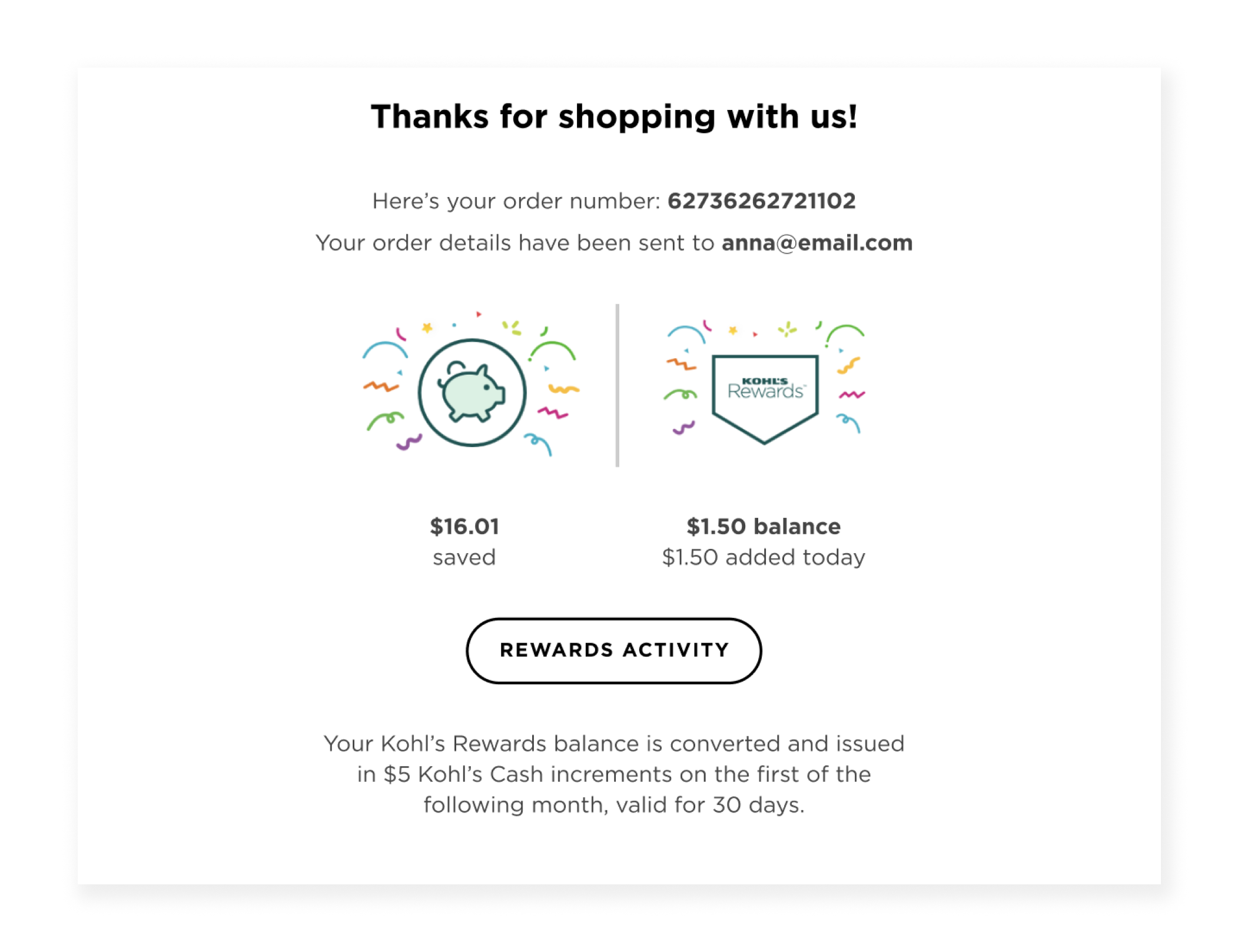

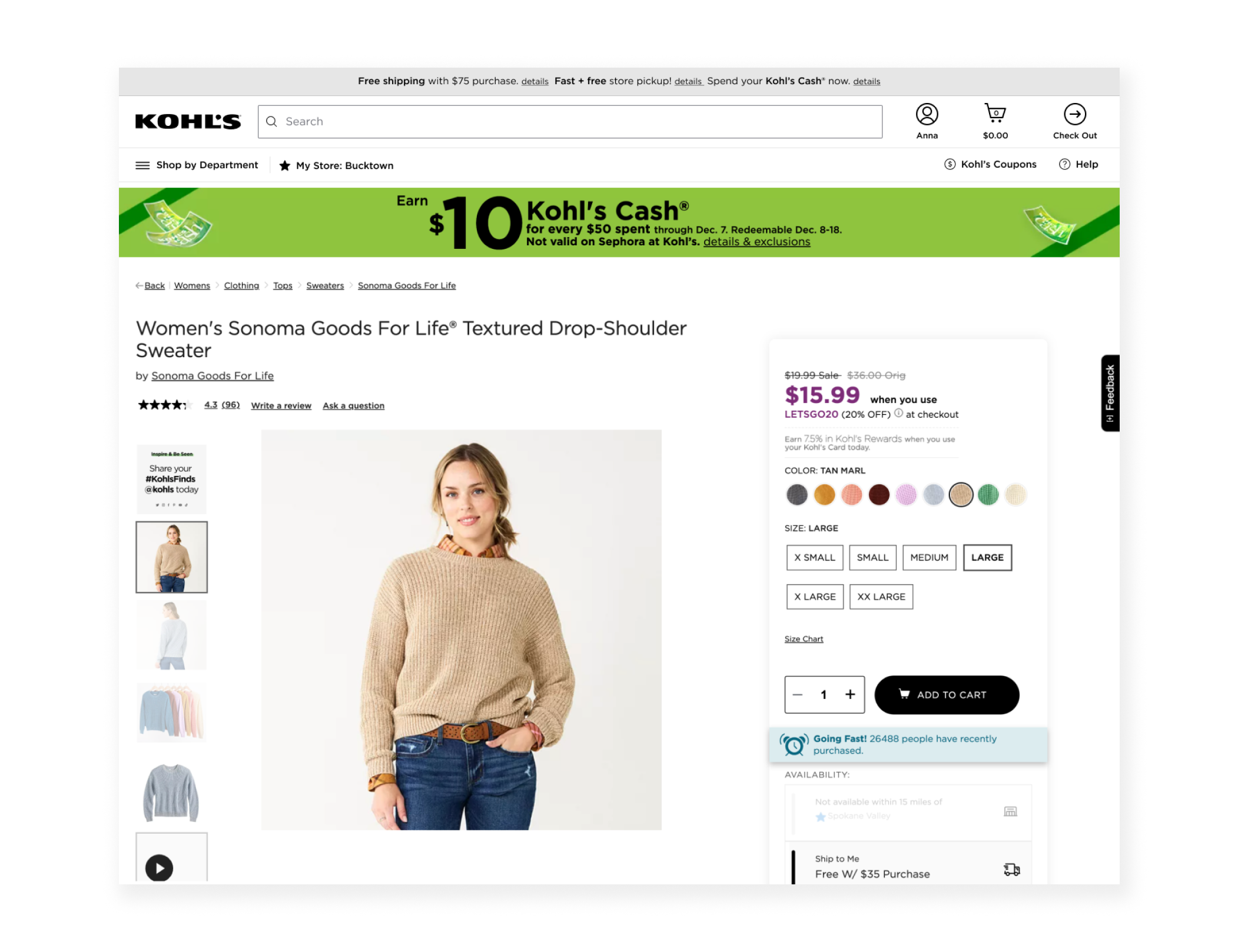

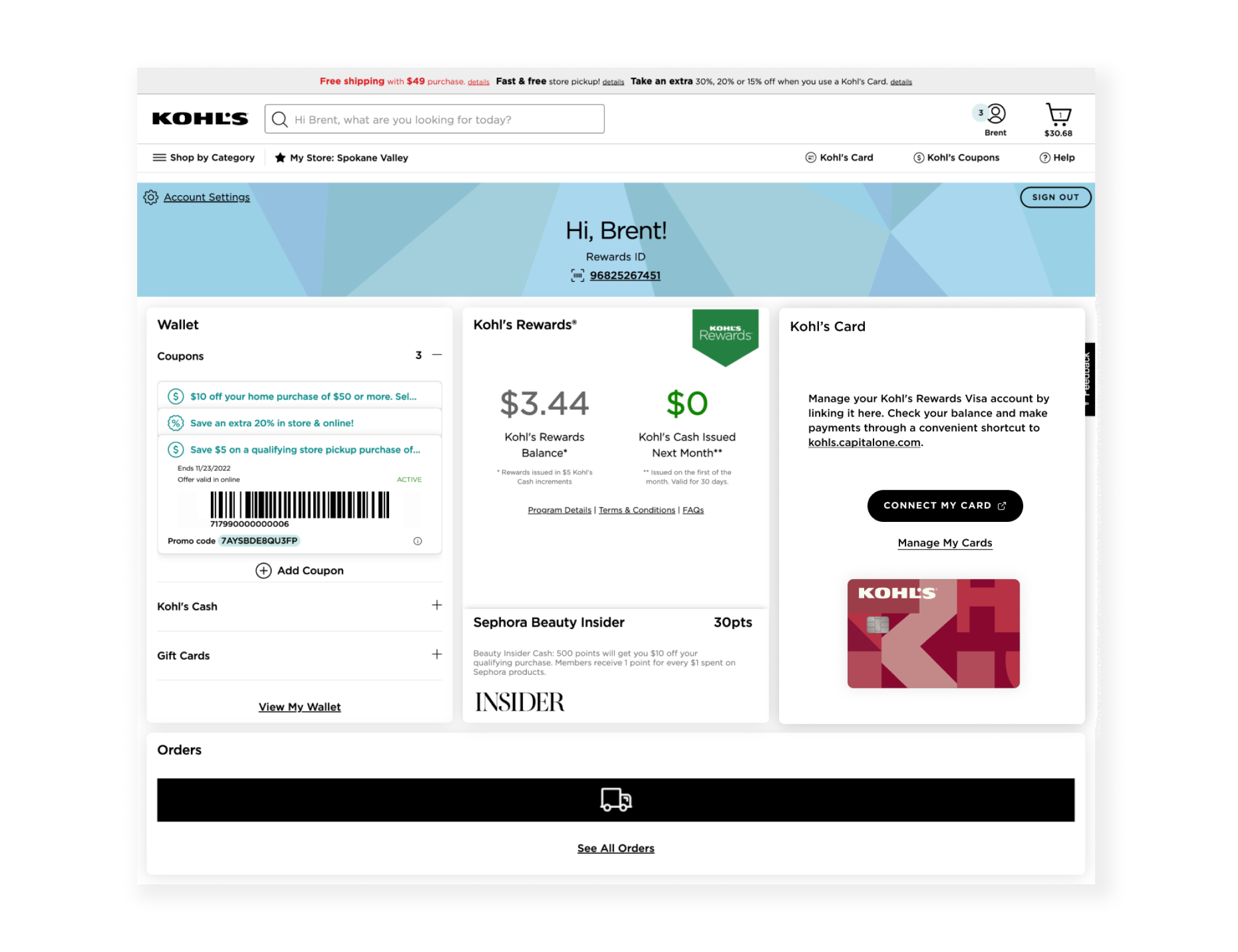

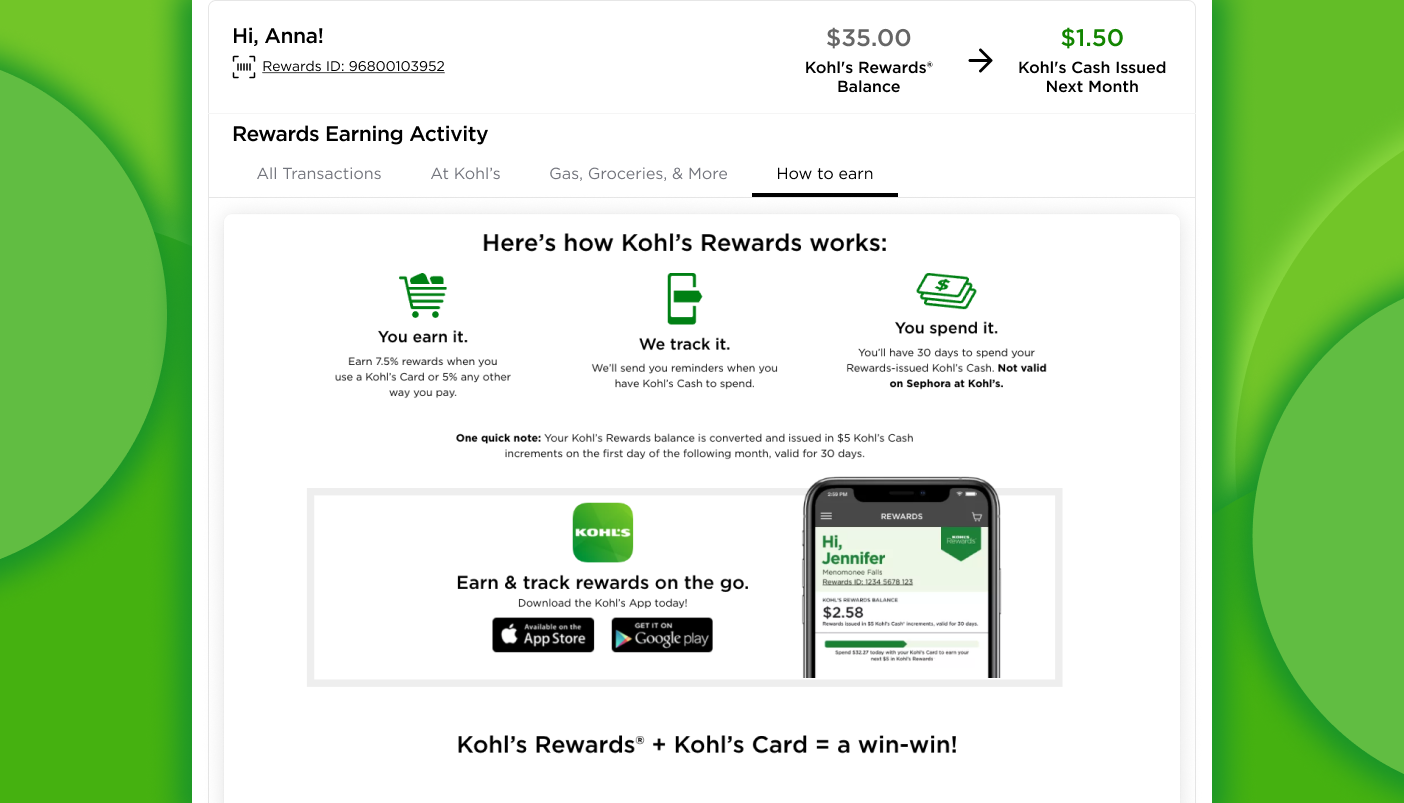

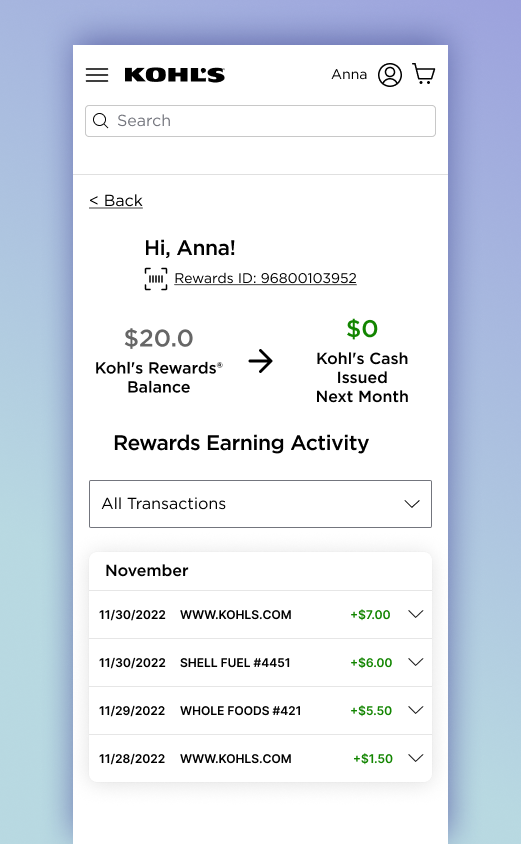

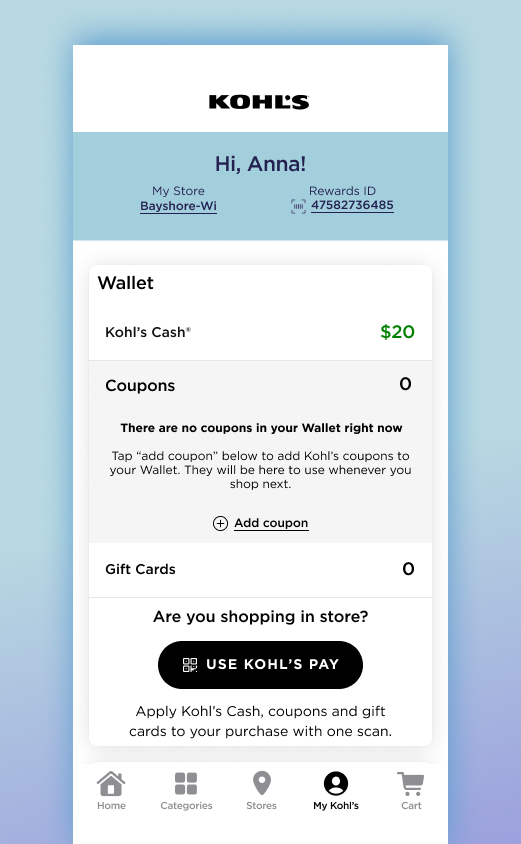

Rewards & Management

The Rewards area was a key target for us since the success of the card was largely influenced by the ease of understanding how rewards could be earned and redeemed. To this end we completely redesigned the rewards exeprience to make it easier to undertsand, track, and use your rewards. We added functionality that customers identified as point points such as a fully formed reward history and a clearer way to track when your rewards were earned and when you'd be eligible to spend them.

Customers could manage their rewards on Kolhs.com but needed to head over to the Capitol One platform to pay off their balance so we needed to ensure that ways back and forth between the two experiences were straightfoward. Our Research indicated that customers appreciated the distinction between the two experiences since they were perfroming entirely different operations in each, and the differences helped prevent confusion about what they could or couldn't do in each location

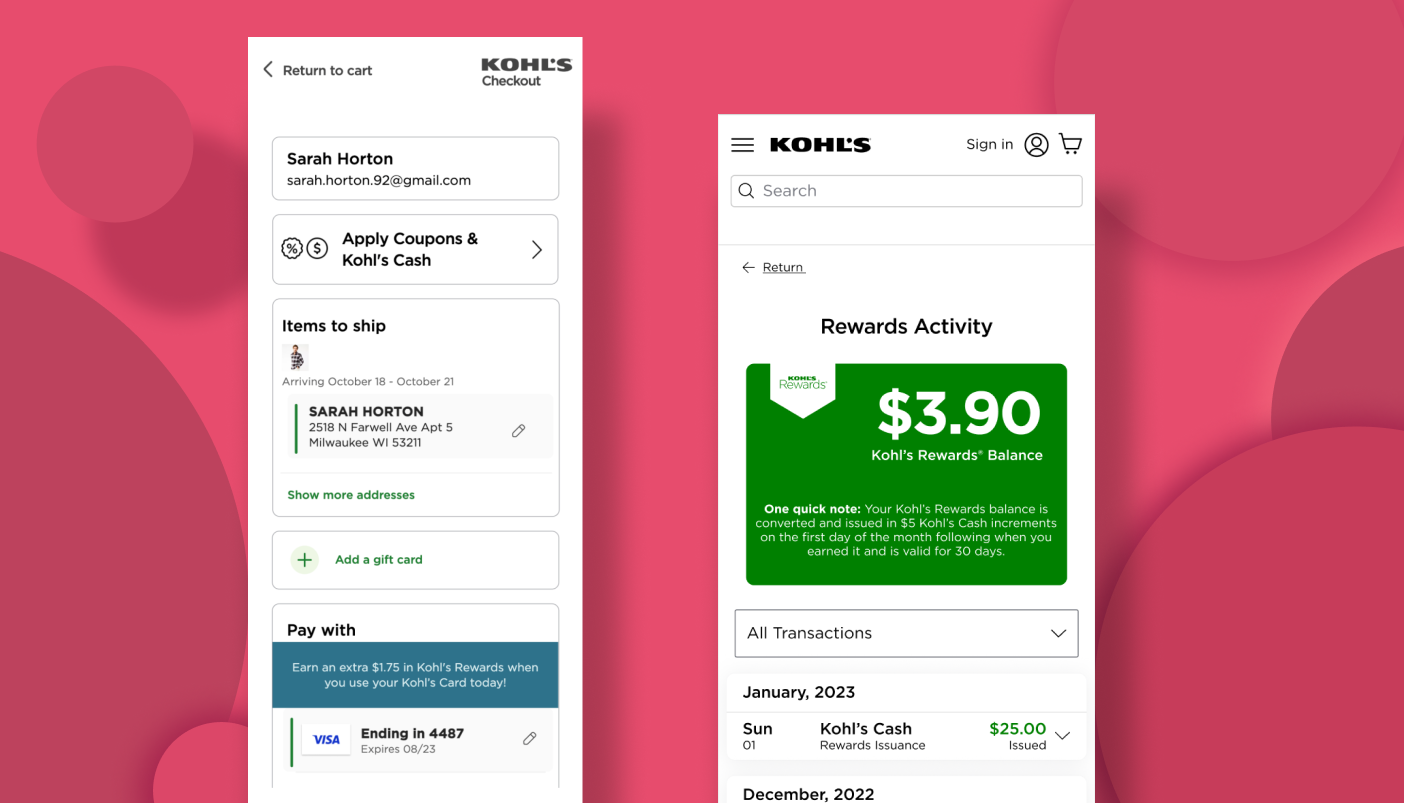

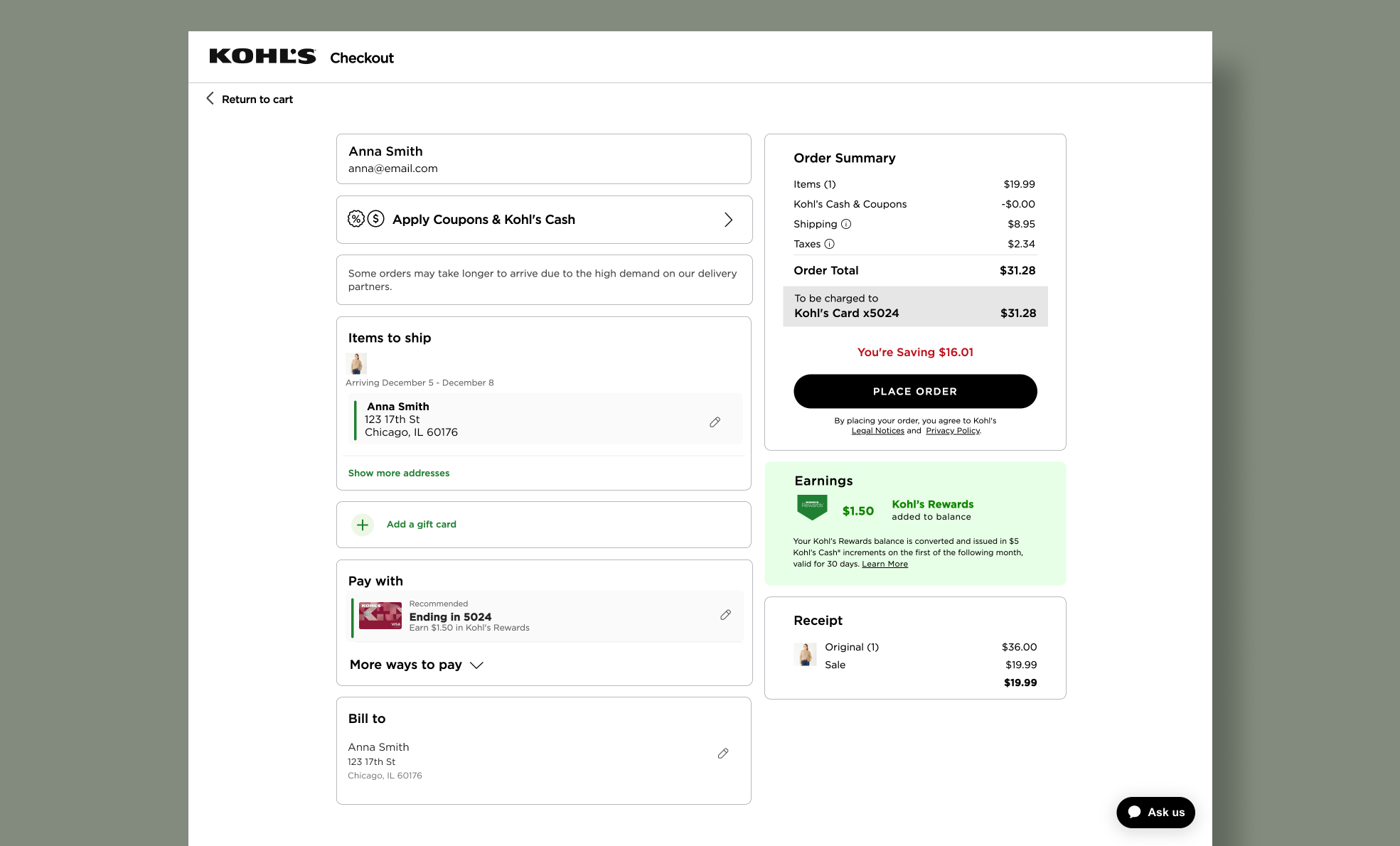

Checkout

We also heavily upgraded our digital checkout experience to make it easier to understand what types of rewards you have, how to apply them to your purchase, and effortlessly let users attach their new card to their profile and use it without friction.

The Results

This initiative was enormous, involved over 80 employees, and was a massive effort to revolutionize our credit experience for customers. Customers were extremely excited to be upgraded and we received signficantly positive feedback. Additionally activation rates and credit use far exceeded our expectations:

Revenue Generation

We were able to acheive $410 Million in revenue in the first year driven by a staggering $810 milion in internal and external spend on the card by customers

High Activation

The activation rate exceeded expectations of all parties with a 77% activation rate to date, dramatically exceeding the Capitol One benchmark of 60%

A Bold First Step

We set out with an ambitious goal to convert 1 million customers, which is no small feat. We were able to launch with nearly that many credit customers without incident and fanfare.